"It's about the inspiring story of a couple that sold their huge house in Chilliwack and was able to afford a 2 bedroom in Kitsilano."

🏡 2025 Year End Report and 2026 ForecastThe real estate landscape in British Columbia shifted significantly in 2025. After years of frenzied demand, the market in Greater Vancouver cooled to its slowest sales pace in over two decades, transitioning firmly into a buyer's market. Vancouver Island displayed more resilience, maintaining balanced conditions with stable pricing despite broader economic headwinds.Looking ahead to 2026, the market faces a "reset." While interest rates have likely hit their bottom, a projected decline in population growth (specifically non-permanent residents) and a surplus of inventory suggest that price growth will remain muted, with affordability improving slightly for buyers and renters.

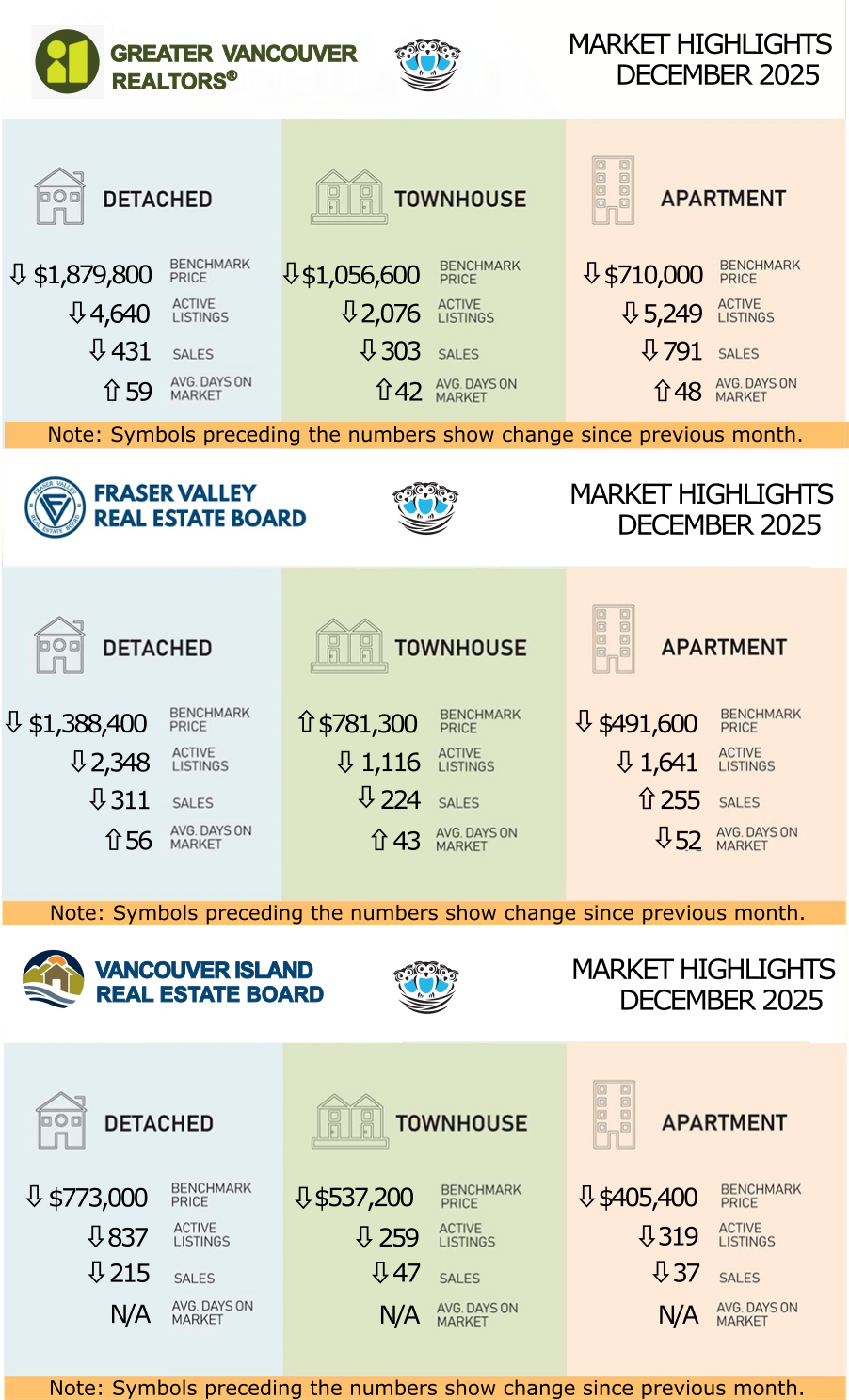

GREATER VANCOUVER: 2025 saw lowest annual sales total in over two decadesSales Activity: The region recorded approximately 23,800 sales in 2025, a 10.4% decrease from 2024. This marks the lowest annual sales total in over 20 years, falling nearly 25% below the 10-year average.Inventory: Sellers were active despite low demand, listing over 65,000 properties, the highest number of new listings since the mid-1990s. Active inventory ended the year up roughly 14.6% compared to 2024.Prices: The composite benchmark price dropped to roughly $1,114,800, a 4.5% year-over-year decline. Detached homes and condos both saw price corrections of approximately 5.3%.Market Trend: High inventory and low sales have created clear "Buyers’ Market" conditions. Properties are taking longer to sell, and buyers have increased leverage to negotiate.Full statistics package for Greater Vancouver.

GREATER VANCOUVER: 2025 saw lowest annual sales total in over two decadesSales Activity: The region recorded approximately 23,800 sales in 2025, a 10.4% decrease from 2024. This marks the lowest annual sales total in over 20 years, falling nearly 25% below the 10-year average.Inventory: Sellers were active despite low demand, listing over 65,000 properties, the highest number of new listings since the mid-1990s. Active inventory ended the year up roughly 14.6% compared to 2024.Prices: The composite benchmark price dropped to roughly $1,114,800, a 4.5% year-over-year decline. Detached homes and condos both saw price corrections of approximately 5.3%.Market Trend: High inventory and low sales have created clear "Buyers’ Market" conditions. Properties are taking longer to sell, and buyers have increased leverage to negotiate.Full statistics package for Greater Vancouver.

FRASER VALLEY: 2025 Fraser Valley housing market slowest in over two decades

despite falling prices and decade-high inventorySales Activity: The board recorded 12,224 sales in 2025, a 16% decrease from 2024 and 33% below the 10-year average. This was the quietest year for transactions in a quarter-century, despite the region's population being significantly larger than it was in 2000.Inventory: Sellers were highly active. New listings soared to nearly 38,000, the highest level in over four decades. Active inventory remained elevated throughout the year, giving buyers more choice than they have had in years.Prices: The Composite Benchmark price ended the year at $905,900, down 6% year-over-year.Market Trend: The defining characteristic of 2025 was Inventory Accumulation. Unlike Vancouver Island’s resilience, the Fraser Valley saw a clear correction as sellers listed homes that buyers simply couldn't afford at prevailing rates.Full statistics package for the Fraser Valley.

VANCOUVER ISLAND: One word defined VIREB’s housing market in 2025: ResilienceSales Activity: The Island market was more stable. The Vancouver Island Real Estate Board (VIREB) recorded roughly 7,620 unit sales, a slight 2% increase over 2024, demonstrating resilience compared to the Mainland.Prices: Property values remained relatively flat. 2026 property assessments indicate that most homeowners will see changes in the range of -5% to +5%, reflecting a stable valuation environment.Rental Market: Victoria saw a dramatic shift, with vacancy rates rising to 3.3%, the highest level since 1999, driven by new purpose-built rental supply coming to market.Full statistics package for Vancouver Island.

2026 OUTLOOK & ECONOMIC INDICATORS1. Interest RatesStatus: The Bank of Canada held the overnight rate at 2.25% in December 2025.Forecast: We are likely at or near the bottom of the easing cycle. Forecasts for 2026 suggest rates will remain relatively flat. While variable rates are expected to stay low, fixed rates could see minor fluctuations or slight increases if bond yields rise. Unfortunately, buyers and builders should not expect significant further rate cuts to bail out affordability in 2026.2. Migration & PopulationTrend: This is the most significant shift for 2026. Due to federal reductions in non-permanent resident targets, BC’s population growth is forecast to slow drastically.Forecast: Projections indicate BC could see a net population decline (potentially -13,000 people) in 2026 as temporary visas expire and fewer international students/workers arrive. This will significantly dampen housing demand and household formation, removing a key driver of rent and price appreciation.3. Rental RatesTrend: The era of double-digit rent increases appears to be over.Greater Vancouver: With vacancy rates jumping to 3.7% (a 30-year high) and population growth stalling, rents have begun to soften.Forecast: Rents are expected to stabilize or decline further in 2026. Landlords will face increased competition to attract tenants, particularly for condos, as new completions add supply to a shrinking pool of renter demand.4. Building StartsTrend: Housing starts are forecast to moderate, averaging around 49,000 units provincially.Shift: Developers are pulling back on condo projects due to high costs and vanishing investor interest. However, purpose-built rental construction remains active, though potentially peaking.Forecast: Expect a slowdown in new project launches in 2026. The "pre-sale" condo market will likely remain frozen as investors—who traditionally drive this sector—retreat to safer assets.5. EmploymentTrend: The job market is softening. Unemployment in Vancouver hovered around 6.2% late in 2025.Forecast: Unemployment may tick upward in the first half of 2026 before stabilizing. While the long-term outlook predicts 1 million job openings over the next decade, 2026 will be a slower year for job growth, dampening consumer confidence and home-buying intentions.Conclusion2026 is shaping up to be a year of opportunity for buyers and tenants. With record inventory, high vacancy rates, and a "reset" in population growth, the frantic competition of recent years has evaporated. Sellers and landlords will need to be realistic with pricing, while buyers can take their time to find the right property.

2026 OUTLOOK & ECONOMIC INDICATORS1. Interest RatesStatus: The Bank of Canada held the overnight rate at 2.25% in December 2025.Forecast: We are likely at or near the bottom of the easing cycle. Forecasts for 2026 suggest rates will remain relatively flat. While variable rates are expected to stay low, fixed rates could see minor fluctuations or slight increases if bond yields rise. Unfortunately, buyers and builders should not expect significant further rate cuts to bail out affordability in 2026.2. Migration & PopulationTrend: This is the most significant shift for 2026. Due to federal reductions in non-permanent resident targets, BC’s population growth is forecast to slow drastically.Forecast: Projections indicate BC could see a net population decline (potentially -13,000 people) in 2026 as temporary visas expire and fewer international students/workers arrive. This will significantly dampen housing demand and household formation, removing a key driver of rent and price appreciation.3. Rental RatesTrend: The era of double-digit rent increases appears to be over.Greater Vancouver: With vacancy rates jumping to 3.7% (a 30-year high) and population growth stalling, rents have begun to soften.Forecast: Rents are expected to stabilize or decline further in 2026. Landlords will face increased competition to attract tenants, particularly for condos, as new completions add supply to a shrinking pool of renter demand.4. Building StartsTrend: Housing starts are forecast to moderate, averaging around 49,000 units provincially.Shift: Developers are pulling back on condo projects due to high costs and vanishing investor interest. However, purpose-built rental construction remains active, though potentially peaking.Forecast: Expect a slowdown in new project launches in 2026. The "pre-sale" condo market will likely remain frozen as investors—who traditionally drive this sector—retreat to safer assets.5. EmploymentTrend: The job market is softening. Unemployment in Vancouver hovered around 6.2% late in 2025.Forecast: Unemployment may tick upward in the first half of 2026 before stabilizing. While the long-term outlook predicts 1 million job openings over the next decade, 2026 will be a slower year for job growth, dampening consumer confidence and home-buying intentions.Conclusion2026 is shaping up to be a year of opportunity for buyers and tenants. With record inventory, high vacancy rates, and a "reset" in population growth, the frantic competition of recent years has evaporated. Sellers and landlords will need to be realistic with pricing, while buyers can take their time to find the right property.