As the year draws to a close, November's real estate data continues the trend of a slow-paced, cautious market across the Lower Mainland, with sales volumes remaining below seasonal averages. Inventory remains healthy and plentiful, providing buyers ample choice and time to deliberate.

This prevailing high-inventory, low-sale environment has firmly established a buyer's market in the Fraser Valley and has pushed the Greater Vancouver region to the cusp of downward pricing pressure. Sellers are acknowledging this shift, with Fraser Valley leadership noting that encouraging signs for buyers include composite prices closer to early-2023 levels, improved inventory, and "more space to negotiate than we've had in recent years".

While the mainland markets navigate softening prices and subdued demand, the Vancouver Island Real Estate Board (VIREB) reports its market remains "relatively stable," positioned at the high end of balanced territory.The key constraint influencing transactions remains mortgage conditions. With borrowing costs likely to remain steady into the new year, any significant change in demand will depend on a change in buyer sentiment.

This prevailing high-inventory, low-sale environment has firmly established a buyer's market in the Fraser Valley and has pushed the Greater Vancouver region to the cusp of downward pricing pressure. Sellers are acknowledging this shift, with Fraser Valley leadership noting that encouraging signs for buyers include composite prices closer to early-2023 levels, improved inventory, and "more space to negotiate than we've had in recent years".

While the mainland markets navigate softening prices and subdued demand, the Vancouver Island Real Estate Board (VIREB) reports its market remains "relatively stable," positioned at the high end of balanced territory.The key constraint influencing transactions remains mortgage conditions. With borrowing costs likely to remain steady into the new year, any significant change in demand will depend on a change in buyer sentiment.

GREATER VANCOUVER

Housing market sees little change as year-end nears

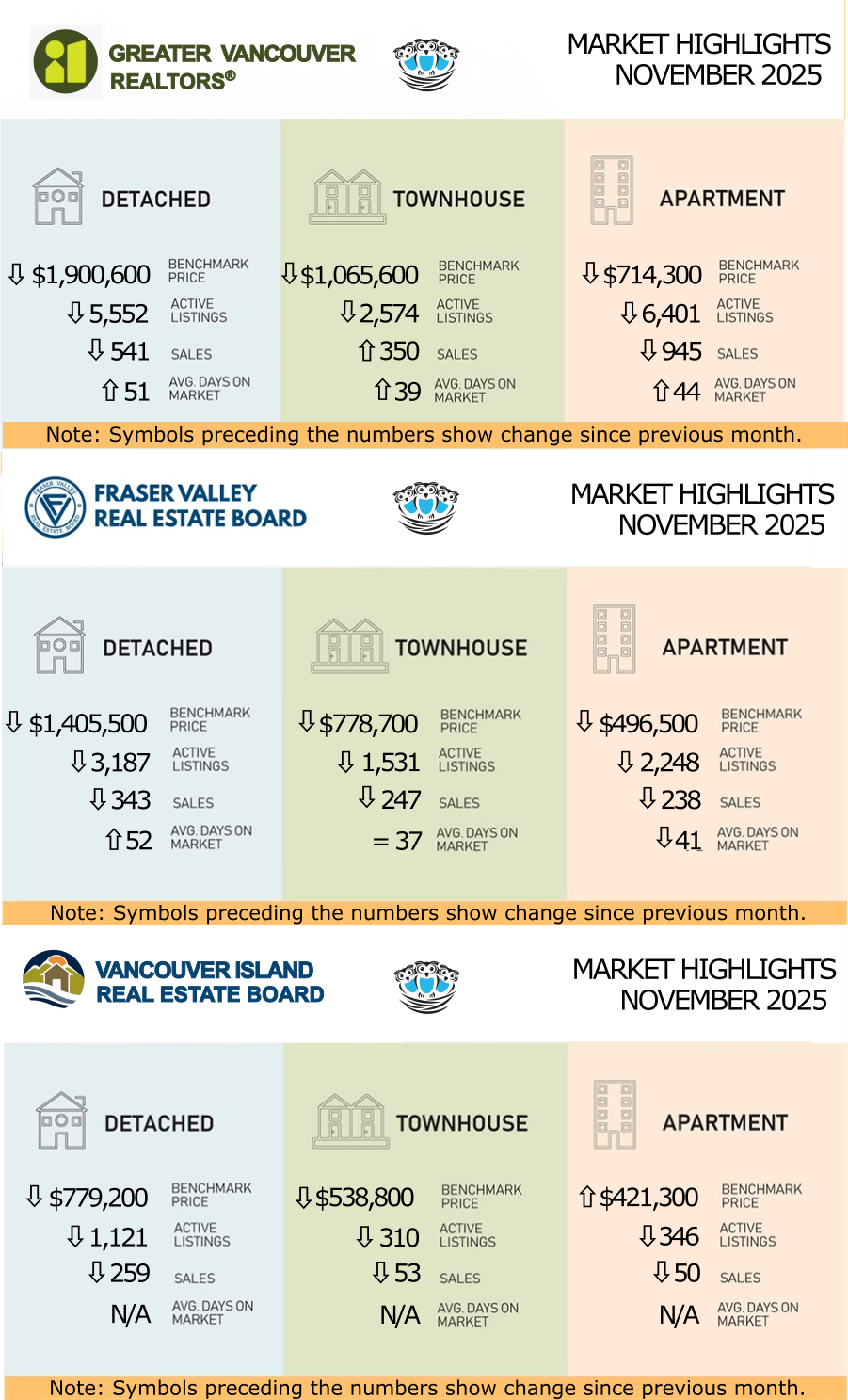

Greater Vancouver REALTORS® (GVR) reported that home-sale trends observed in October continued in November, with sales lower than this time last year.Residential sales totaled 1,846, a 15.4% decrease from November 2024 and 20.6% below the 10-year seasonal average. The total number of active properties for sale is 15,149, representing a 14.4% increase compared to November 2024 and standing 36.3% above the 10-year seasonal average. The overall sales-to-active listings ratio is 12.6%, which is edging toward the 12% threshold where downward pressure on prices typically occurs.

The ratio for detached homes is 9.7%, firmly in buyer's market territory.The MLS® Home Price Index composite benchmark price is $1,123,700, a 3.9% decrease from November 2024 and a 0.3% decrease compared to October 2025. The benchmark price for a detached home is $1,900,600, down 4.3% from last year. The benchmark price for a townhouse is $1,065,600, down 4.4% from last year but showing a slight 0.1% increase over October 2025.

Access the full statistics package HERE.

FRASER VALLEY

Early fall momentum slows as Fraser Valley sales dip in November

The Fraser Valley Real Estate Board noted that easing prices and abundant inventory were "not enough to entice buyers" in November, as sales declined in line with seasonal patterns. The Board recorded 943 sales, a 17% decrease from the same month last year and a 16% decrease from October.Overall inventory is 47% above the 10-year seasonal average. The 9,201 active listings recorded were down 9% from October.The region remains firmly in a buyer's market, with an overall sales-to-active listings ratio of 10%, which is below the balanced range of 12% to 20%.

The composite Benchmark price for a typical home decreased 0.7% month-over-month to $912,400. The detached benchmark price is $1,405,500, down 5.4% year-over-year. The townhome benchmark price is $778,700, down 6.8% year-over-year.

Access the full statistics package HERE.

VANCOUVER ISLAND

Continued stability reflects confidence in housing market

The Vancouver Island Real Estate Board (VIREB) characterized its market as "relatively stable," with conditions at the high end of balanced territory. VIREB recorded 513 unit sales (all property types) in November 2025, down 8% from one year ago. Active listings (all property types) rose 5% year-over-year to 3,646.

The board-wide benchmark price for a single-family home was $779,200, an increase of 2% from November 2024. The apartment category benchmark price was $421,300, showing an even stronger 7% increase year-over-year. The townhouse benchmark price was $538,800, down 1% from the prior year.

Access the full statistics package HERE.

Housing market sees little change as year-end nears

Greater Vancouver REALTORS® (GVR) reported that home-sale trends observed in October continued in November, with sales lower than this time last year.Residential sales totaled 1,846, a 15.4% decrease from November 2024 and 20.6% below the 10-year seasonal average. The total number of active properties for sale is 15,149, representing a 14.4% increase compared to November 2024 and standing 36.3% above the 10-year seasonal average. The overall sales-to-active listings ratio is 12.6%, which is edging toward the 12% threshold where downward pressure on prices typically occurs.

The ratio for detached homes is 9.7%, firmly in buyer's market territory.The MLS® Home Price Index composite benchmark price is $1,123,700, a 3.9% decrease from November 2024 and a 0.3% decrease compared to October 2025. The benchmark price for a detached home is $1,900,600, down 4.3% from last year. The benchmark price for a townhouse is $1,065,600, down 4.4% from last year but showing a slight 0.1% increase over October 2025.

Access the full statistics package HERE.

FRASER VALLEY

Early fall momentum slows as Fraser Valley sales dip in November

The Fraser Valley Real Estate Board noted that easing prices and abundant inventory were "not enough to entice buyers" in November, as sales declined in line with seasonal patterns. The Board recorded 943 sales, a 17% decrease from the same month last year and a 16% decrease from October.Overall inventory is 47% above the 10-year seasonal average. The 9,201 active listings recorded were down 9% from October.The region remains firmly in a buyer's market, with an overall sales-to-active listings ratio of 10%, which is below the balanced range of 12% to 20%.

The composite Benchmark price for a typical home decreased 0.7% month-over-month to $912,400. The detached benchmark price is $1,405,500, down 5.4% year-over-year. The townhome benchmark price is $778,700, down 6.8% year-over-year.

Access the full statistics package HERE.

VANCOUVER ISLAND

Continued stability reflects confidence in housing market

The Vancouver Island Real Estate Board (VIREB) characterized its market as "relatively stable," with conditions at the high end of balanced territory. VIREB recorded 513 unit sales (all property types) in November 2025, down 8% from one year ago. Active listings (all property types) rose 5% year-over-year to 3,646.

The board-wide benchmark price for a single-family home was $779,200, an increase of 2% from November 2024. The apartment category benchmark price was $421,300, showing an even stronger 7% increase year-over-year. The townhouse benchmark price was $538,800, down 1% from the prior year.

Access the full statistics package HERE.

💰 Future Outlook

Lower Mainland Trends:

The high inventory levels across Greater Vancouver and the Fraser Valley (combined with suppressed sales activity) confirm the buyer's advantage. With single-family sales-to-active ratios hitting 9.7% in GVR and the composite ratio at 10% in FVREB, price stabilization remains unlikely for now, and further slight softening is expected as properties take longer to sell. The expectation that borrowing costs will remain steady into the new year means that market activity is likely to see a "quiet close" to 2025.

Vancouver Island Resilience:

The VIREB market has proven more resilient this year compared to the Lower Mainland. The continued price increases in the single-family and apartment categories (up 2% and 7% year-over-year, respectively) highlight a localized strength. This stability is expected to continue into 2026, offering both buyers and sellers a healthy and predictable environment.

🔍 What This Means for You

Buyers in the Lower Mainland continue to hold a strong advantage. Greater Vancouver is a market defined by inventory being "plentiful" and the Fraser Valley remaining "firmly in a buyer's market". With sales-to-active listings ratios at 12.6% in Greater Vancouver and 10% in the Fraser Valley, buyers face low competition and highly favorable negotiating conditions. In contrast, the Vancouver Island market is described as stable, presenting excellent opportunities for buyers and sellers.

Sellers in the Lower Mainland must continue to navigate a highly competitive landscape. With inventory levels high and prices easing across most segments, success hinges on aligning pricing expectations with the current market reality.