A Typical Fall Showing

The real estate market remained subdued in October, despite the Bank of Canada issuing another policy rate cut at the end of the month. This fourth cut of the year was reportedly "not enough to entice more buyers" back into the market in a significant way, with sales volumes in the mainland regions continuing to lag behind 10-year seasonal averages.

With the central bank now signaling that rates are "about the right level" and no further cuts are expected in 2025, the market has settled into a predictable, slower-paced pattern. This has firmly established a buyer's market across the Lower Mainland, giving purchasers a distinct edge with more negotiating power and time to make decisions.

This high-inventory, low-sale environment has clearly shifted the mindset of market participants. Buyers, no longer facing intense competition, are cautious and responding primarily to steadily easing prices. Motivated sellers, in turn, are on the defensive and must adopt more realistic pricing strategies to secure a sale.

While the mainland is tilted toward buyers, Vancouver Island reported a more balanced environment. This stability was seen as creating a healthy environment with good opportunities for both buyers and sellers, highlighting a stable regional market.

While the resale market is characterized by high inventory, a different supply-side issue is emerging in the new-construction sector. Recent reports on housing starts, particularly for condominium apartments in key areas like Vancouver, have shown a sharp decline. This is largely attributed to weak presales, which have forced developers to pause or cancel projects. In contrast, there has been a notable shift toward rental construction, with purpose-built rentals making up a growing share of new builds, indicating a clear divergence in the new-home pipeline.

As realtors, we can always tell when presales are under pressure as developers start to offer higher incentives to realtors bringing buyers into their showrooms.

With the central bank now signaling that rates are "about the right level" and no further cuts are expected in 2025, the market has settled into a predictable, slower-paced pattern. This has firmly established a buyer's market across the Lower Mainland, giving purchasers a distinct edge with more negotiating power and time to make decisions.

This high-inventory, low-sale environment has clearly shifted the mindset of market participants. Buyers, no longer facing intense competition, are cautious and responding primarily to steadily easing prices. Motivated sellers, in turn, are on the defensive and must adopt more realistic pricing strategies to secure a sale.

While the mainland is tilted toward buyers, Vancouver Island reported a more balanced environment. This stability was seen as creating a healthy environment with good opportunities for both buyers and sellers, highlighting a stable regional market.

While the resale market is characterized by high inventory, a different supply-side issue is emerging in the new-construction sector. Recent reports on housing starts, particularly for condominium apartments in key areas like Vancouver, have shown a sharp decline. This is largely attributed to weak presales, which have forced developers to pause or cancel projects. In contrast, there has been a notable shift toward rental construction, with purpose-built rentals making up a growing share of new builds, indicating a clear divergence in the new-home pipeline.

As realtors, we can always tell when presales are under pressure as developers start to offer higher incentives to realtors bringing buyers into their showrooms.

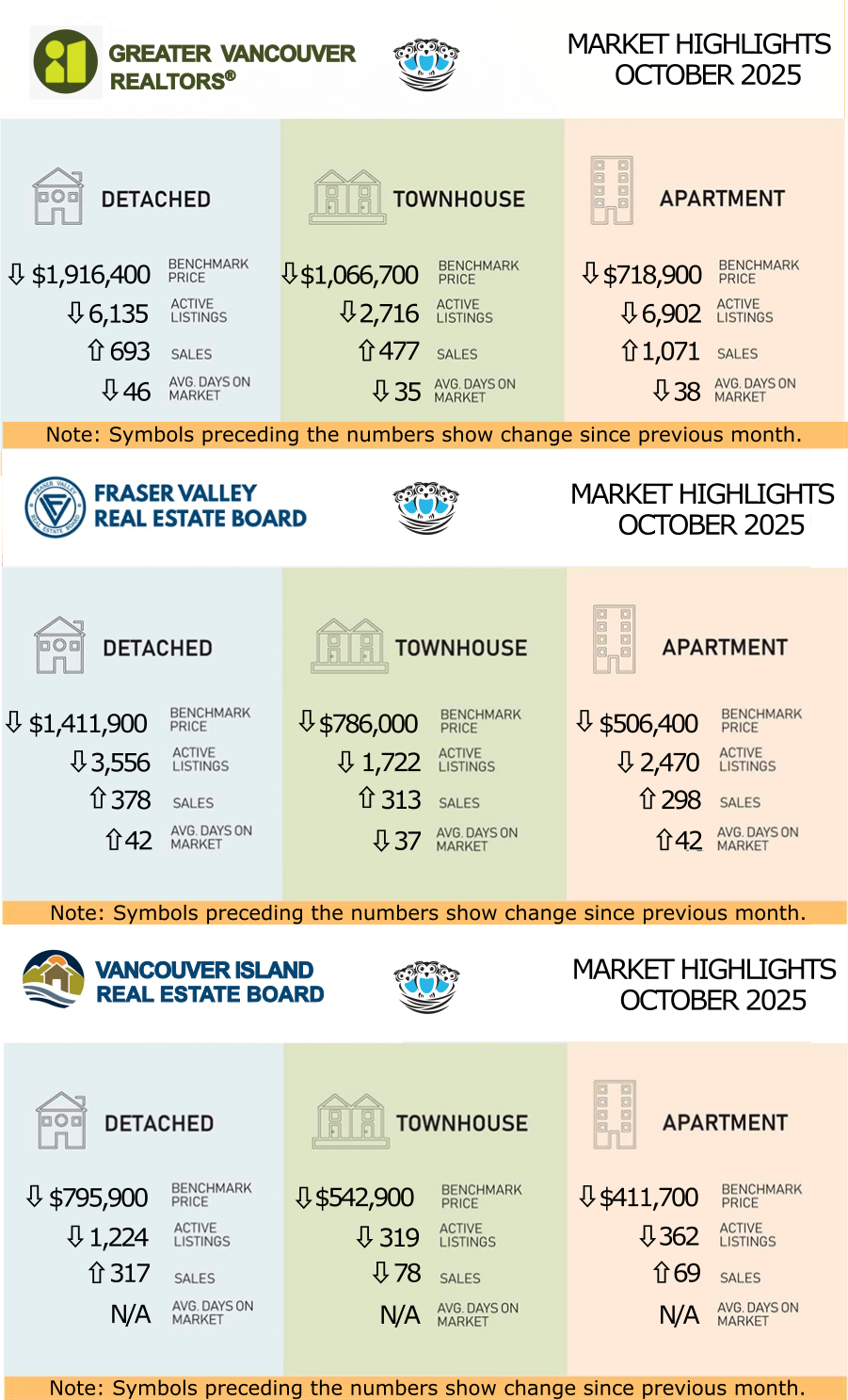

GREATER VANCOUVER

Slow sales and high inventory give buyers the edge in October

Greater Vancouver REALTORS® (GVR) reported that "slow sales and high inventory" gave buyers the edge in October. Residential sales totaled 2,255, marking a 14.3% decrease from October 2024 and falling 14.5% below the 10-year seasonal average. While sales slowed, inventory grew significantly; the 16,393 properties currently listed are 13.2% higher than last year and 35.9% above the 10-year average. This imbalance has created "favourable conditions" for buyers and caused prices to ease. The MLS® HPI composite benchmark price for all residential properties dropped to $1,132,500, a 3.4% decrease year-over-year and a 0.8% decline from September 2025.Access the full statistics package HERE.

FRASER VALLEY

October brings welcome boost to Fraser Valley, but sales still lag seasonal averages

The Fraser Valley real estate market remained firmly in a buyer's market in October, according to the Fraser Valley Real Estate Board. While sales saw a 17% boost from September to 1,123 transactions, this figure was still 16% below October 2024 levels. This buyer's advantage is reflected in pricing, with the composite Benchmark price softening by 0.7% from the previous month to $919,900. With a sales-to-active-listings ratio of 11% and overall inventory up 15% year-over-year , the board noted that "motivated sellers are responding... with more realistic pricing strategies".Access the full statistics package HERE.

VANCOUVER ISLAND

Balanced conditions define local housing market this Fall

The Vancouver Island Real Estate Board (VIREB) characterized its October housing market as "balanced," noting its "stability and resilience". There were 649 sales of all property types, a 9% decrease from the previous year. Sales of single-family homes were down 8% year-over-year but saw a 3% increase from September. Unlike mainland regions, prices showed year-over-year strength; the benchmark price for a single-family home was $795,900, up 2% from October 2024. Total active listings were down 4% from the prior year, with the board CEO stating the balanced conditions "present excellent opportunities for buyers and sellers".Access the full statistics package HERE.

💰 Future Outlook - Macroeconomic Factors:

Canada’s CPI held steady at 1.6% year-over-year in September, signaling continued disinflation. The 5-year Government of Canada (GoC) bond yield dipped slightly to 2.65%, reflecting market anticipation of further monetary easing.Interest Rates: Following the Bank of Canada’s rate cut on September 17, borrowing costs have become more favourable. Another cut is being priced in for December, which could further stimulate buyer activity and support price stabilization across key regions.

🔍 What This Means for You

Buyers in the Lower Mainland continue to hold a strong advantage. Greater Vancouver is a market defined by slow sales and high inventory, giving buyers the edge, while the Fraser Valley remains firmly in a buyer's market. With sales-to-active listings ratios at 11% in the Fraser Valley and 14.2% in Greater Vancouver (and 11.3% for detached homes), buyers face less competition and favourable conditions.

In contrast, the Vancouver Island market is described as balanced, presenting a healthy environment for both buyers and sellers. Sellers must navigate a highly competitive landscape. With inventory levels in Greater Vancouver at the highest inventory levels seen in many years and prices easing across most segments, success now hinges on realistic pricing strategies.