- Lower the cost of housing development. Development fees are estimated to be around $125K per unit in a high-rise building and $61K in a low-rise building for the city of Vancouver

- Build homes that have utility for families, nothing smaller than 800sf for a 2 bedroom, 1 parking spot per bedroom, no additional amenities in the building, no grand 10 metre high marblelined lobbies with concierge, etc. Target cost per square foot should be $400/sf or less. Quality no luxury.

- The homes above would replace the stopgap measure of "densification by fourplex", as currently being implemented in many Lower Mainland cities.

- Attract the skilled labour to build these homes from either domestic sources or abroad. Employ a minimum wage for construction labour based on training and experience. Ensure quality builds.

- Remove the ability for foreign buyers or investors to buy any of these homes. These homes would be earmarked for first time homebuyers who would be required to live in them for a minimum number of years before selling to the next homeowner.

- Either remove the onerous Property Transfer Tax or increase the threshold to more reasonable levels.

- Create a multiple-offer registry that ensures that all offers are bonafide and not more than a fixed percentage above the next highest offer if above the asking price.

As B.C. moves into 2025, the province stands at a pivotal moment filled with both trials and transformative potential. After a period of economic stagnation and high interest rates, brighter skies are on the horizon. With interest rates easing and inflation largely under control, families, businesses, and investors can look forward to more stability and flexibility in their financial planning. (Certainly, the environment that they expected has been postponed for an indeterminate amount of time.)

A Major Milestone: Megaproject Completions

Four of B.C.’s largest infrastructure undertakings—

- The Site C dam - Cost $16.0B so far

- Coastal GasLink - Cost $14.5B so far

- LNG Canada terminal - Approximately $50B

- Trans Mountain Expansion - $30.9B and counting (Originally estimated at $5.4B.)

Energy, Tech, and Mining: Industries Poised to Grow

- Energy production will surge with the LNG Canada terminal’s launch, opening new export channels and driving upstream investment in B.C.’s northeast.

- The tech and professional services sector continues to expand steadily, backed by B.C.’s well-educated workforce and innovative spirit.

- Mining offers untapped potential, with several critical mineral and gold projects nearing launch—perfectly aligned with the global green transition.

The hybrid work model has found its equilibrium, supporting work-life balance and talent retention across the province. Meanwhile, B.C.’s tourism sector stands to benefit from high-profile events like the Web Summit and Invictus Games, rekindling global interest in its natural beauty and hospitality.

A Time for Renewal and Reinvention

While some sectors like forestry and education face headwinds, these challenges also open the door to reinvention. Communities in Northern B.C., for instance, are being supported by investments in infrastructure and mining, offering new economic lifelines. And as foreign student numbers moderate, domestic students gain greater access to education, supporting a more inclusive and locally grounded economy.

Building on Strengths, Not Waiting for Windfalls

The article wisely notes that B.C.'s historic advantages—from lifestyle appeal to proximity to Asia—are no longer enough on their own. But the province is not short on tools. With a diversified economy, a skilled population, and a legacy of adaptability, B.C. is well-positioned to chart a sustainable path forward—by planning smart, investing in innovation, and making the most of the solid groundwork already in place.

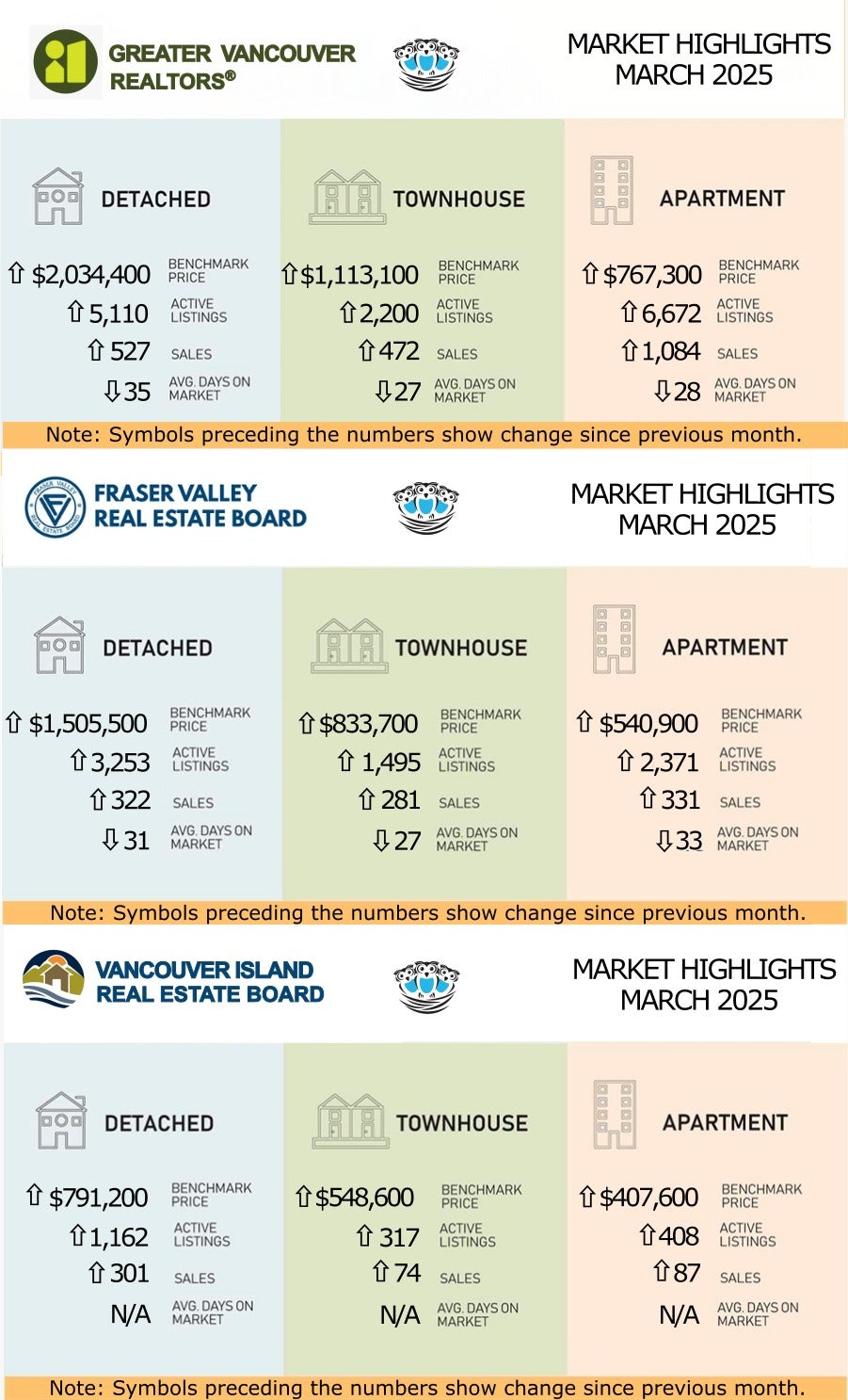

Real Estate Market Overview - March 2025

GVR (Greater Vancouver Real Estate Board)

A MARKET MADE FOR BUYERS IS MISSING BUYERS

“If we can set aside the political and economic uncertainty tied to the new U.S. administration for a moment, buyers in Metro Vancouver haven’t seen market conditions this favourable in years,” said Andrew Lis, GVR’s director of economics and data analytics. “Prices have eased from recent highs, mortgage rates are among the lowest we’ve seen in years, and there are more active listings on the MLS® than we’ve seen in almost a decade. Sellers appear ready to engage — but so far, buyers have not shown up in the numbers we typically see at this time of year.”

LINK to the March 2025 GVR statistics.

FVREB (Fraser Valley Real Estate Board)

TARIFFS, ECONOMIC UNCERTAINTY STALL SPRING MARKET IN THE FRASER VALLEY

“If not for the economic uncertainty driven largely by U.S. tariffs, we’d likely be seeing a typical strong spring market in the Fraser Valley,” said Tore Jacobsen, Chair of the Fraser Valley Real Estate Board. “Instead, we’re seeing a disconnect as sellers remain hesitant to lower their prices beyond a certain threshold, while buyers, facing tighter financing conditions, are either unable or unwilling to meet it. The resulting inertia is keeping sales low.”

LINK to the March 2025 FVREB statistics.

VIREB (Vancouver Island Real Estate Board)

MARKET HOLDING STEADY IN BALANCED TERRITORY

VIREB CEO Jason Yochim reports that with just under six months of inventory, VIREB’s market remains balanced, which is good news for buyers and sellers.