We hope that everyone is enjoying the lovely summer weather.

It may be that there is some additional respite from the Bank of Canada on the horizon, which should be welcome news to those thinking of entering the real estate market, as well as those homeowners that will be renewing soon.

The recent volatility in the stock market caused by the "unwinding" of the Japanese yen carry trades may actually benefit Canadians by driving mortgage interest rates lower.

How that works is that stock market volatility (uncertainty or negative sentiment) will cause investors to move their money into safer investments like bonds as bonds are less risky than stocks.

Then, as more investors buy bonds, the demand grows and drives the prices up. When bond prices go up, the yield or return on the investment goes down. It's an inverse relationship.

Fixed mortgage rates, especially 5 year fixed rates, are influenced by the yields on government bonds. When bond yields fall, it becomes cheaper for banks to borrow money. This can lead to a reduction in fixed mortgage rates as banks compete with other lenders which means that they pass on the lower borrowing costs to consumers.

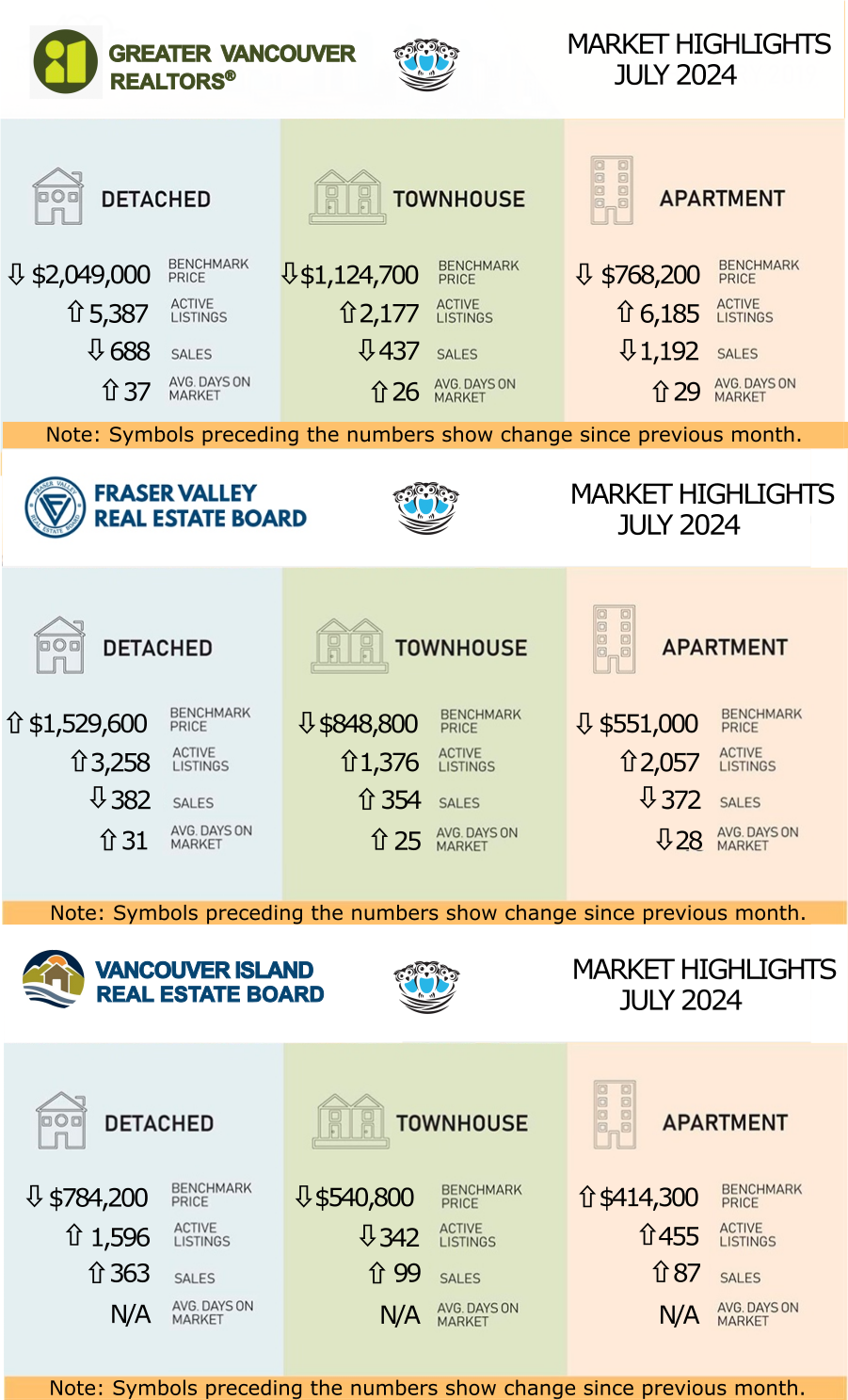

GVR (Formerly REBGV): MORE SELECTION NOT TRANSLATING TO MORE TRANSACTIONS

“The trend of buyers remaining hesitant, that began a few months ago, continued in the July data despite a fresh quarter percentage point cut to the Bank of Canada’s policy rate,” Andrew Lis, GVR’s director of economics and data analytics said. “With the recent half percentage point decline in the policy rate over the past few months, and with so much inventory to choose from, it’s a bit surprising transaction levels remain below historical norms as we enter the mid-point of summer.”

“With the overall market experiencing balanced conditions, and with a healthy level of inventory not seen in quite a few years, price trends across all segments have leveled out with very modest declines occurring month over month,” Lis said. “While it remains to be seen whether softening prices and improved borrowing costs will entice buyers to purchase as we head into the fall market, it’s worth noting that it can take a few months for improvements to borrowing costs to materialize into higher transaction levels. In this respect, it’s still early days, so we will watch the market for signs of transaction activity picking up in the months ahead.”

“With the overall market experiencing balanced conditions, and with a healthy level of inventory not seen in quite a few years, price trends across all segments have leveled out with very modest declines occurring month over month,” Lis said. “While it remains to be seen whether softening prices and improved borrowing costs will entice buyers to purchase as we head into the fall market, it’s worth noting that it can take a few months for improvements to borrowing costs to materialize into higher transaction levels. In this respect, it’s still early days, so we will watch the market for signs of transaction activity picking up in the months ahead.”

LINK to the July 2024 GVR statistics.

FVREB: COOL SUMMER MARKET PERSISTS IN FRASER VALLEY WITH SECOND SLOWEST JULY SALES IN A DECADE

Sluggish seasonally-adjusted sales and a continued rise in inventory has the Fraser Valley market slowly shifting to favour buyers.

“Amidst an overall balanced market, some REALTORS® are experiencing pockets within the Fraser Valley that favour buyers, where prices have come down,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “This is evident in the amount of time buyers have to view a property before considering making an offer. Properties that are well-priced are selling quickly, suggesting motivated buyers are active in the market despite the slowdown.”

“Despite back-to-back policy rate cuts by the Bank of Canada, many first-time homebuyers are still facing challenging market conditions — high interest rates, the mortgage stress test and the need for a substantial down payment,” said FVREB CEO, Baldev Gill.

“Amidst an overall balanced market, some REALTORS® are experiencing pockets within the Fraser Valley that favour buyers, where prices have come down,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “This is evident in the amount of time buyers have to view a property before considering making an offer. Properties that are well-priced are selling quickly, suggesting motivated buyers are active in the market despite the slowdown.”

“Despite back-to-back policy rate cuts by the Bank of Canada, many first-time homebuyers are still facing challenging market conditions — high interest rates, the mortgage stress test and the need for a substantial down payment,” said FVREB CEO, Baldev Gill.

LINK to the July 2024 FVREB statistics.

VIREB: QUIET HOUSING MARKET CLOSES OUT JULY

As VIREB CEO, Jason Yochim noted in recent media releases, the market has behaved differently this year. VIREB’s typical spring and summer market never truly launched. Buyers and sellers are both holding back, despite interest rate reductions and higher inventory. “Inventory has risen considerably, and it’s been five years since active listings in the VIREB area were at this level, so buyers have more choice and more time to wait,” Yochim stated last month. “The same holds true for sellers, so there seems to be a waiting game going on.”

As VIREB CEO, Jason Yochim noted in recent media releases, the market has behaved differently this year. VIREB’s typical spring and summer market never truly launched. Buyers and sellers are both holding back, despite interest rate reductions and higher inventory. “Inventory has risen considerably, and it’s been five years since active listings in the VIREB area were at this level, so buyers have more choice and more time to wait,” Yochim stated last month. “The same holds true for sellers, so there seems to be a waiting game going on.”

LINK to the July 2024 VIREB statistics.