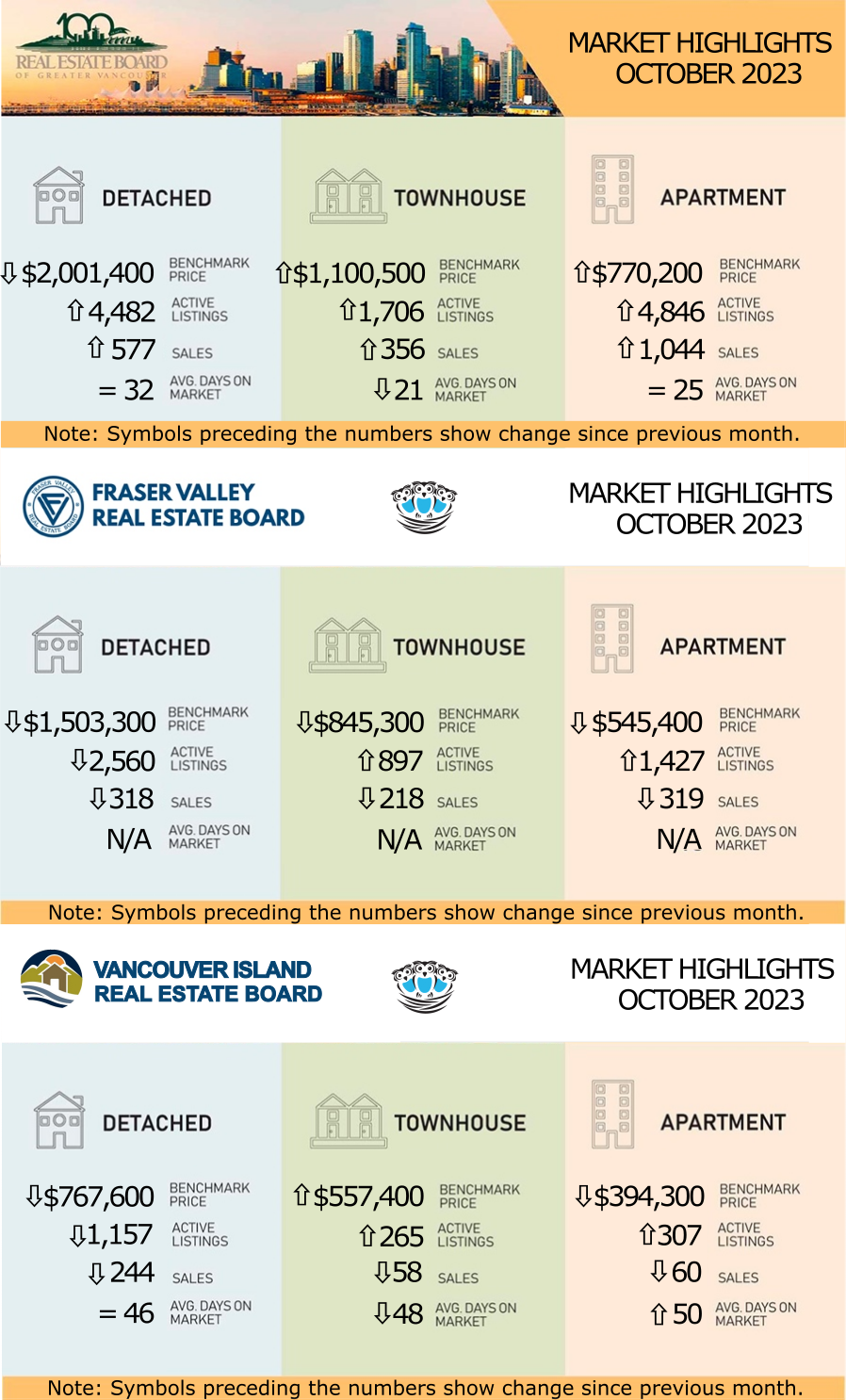

As October drew to a close, the real estate market embraced the spirit of the season with Halloween, ending the month on an eerie note. :^) Listings have started to accumulate, while sales remain lagging. In some areas, we've observed a slight uptick in prices, particularly in the condo segment, possibly owing to their affordability. Detached homes, on the other hand, have witnessed modest price declines, except for older properties on larger lots, which are benefiting from recent increases in buildable density.

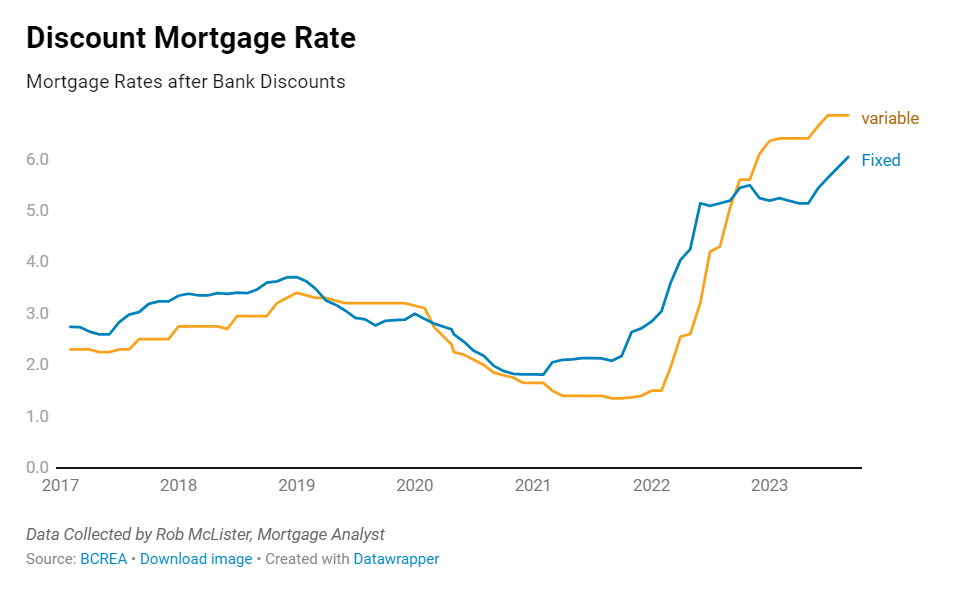

A noteworthy development is the stabilization of the Bank of Canada interest rate which has stayed flat since June. This is bringing a glimmer of hope to first-time buyers and those planning to renew their mortgages in the near future. However, we anticipate limited market movement in the coming months until we observe a reduction in interest rates.

A noteworthy development is the stabilization of the Bank of Canada interest rate which has stayed flat since June. This is bringing a glimmer of hope to first-time buyers and those planning to renew their mortgages in the near future. However, we anticipate limited market movement in the coming months until we observe a reduction in interest rates.

REBGV: METRO VANCOUVER HOUSING MARKET HOLDS STEADY IN OCTOBER

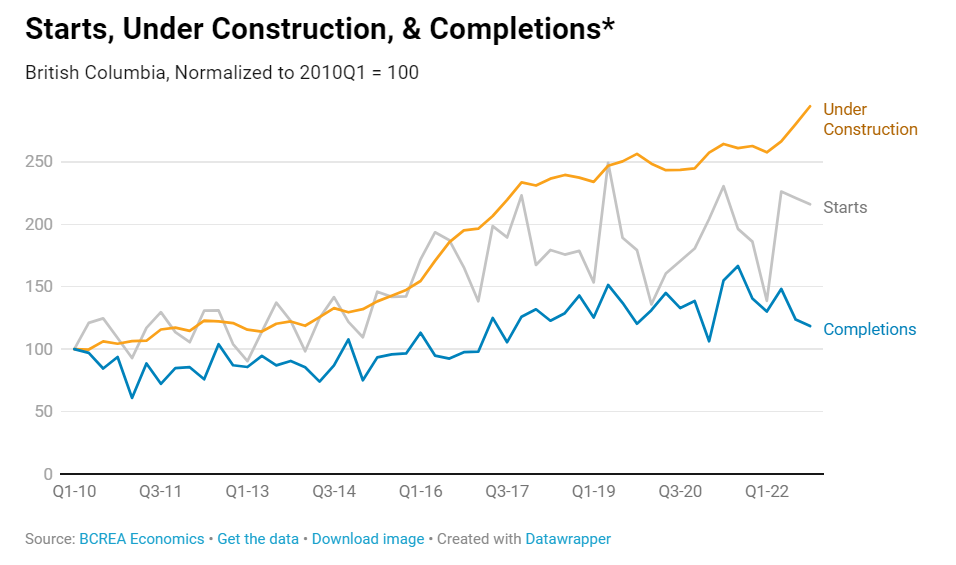

An increase in newly listed properties is providing more choice to home buyers across Metro Vancouver, but sales remain below long-term averages. “With properties coming to market at a rate roughly 5% above the ten-year seasonal average, there seems to be a continuation of the renewed interest on the part of sellers to participate in the market that we’ve been watching this fall,” Andrew Lis, REBGV’s director of economics and data analytics said. “Counterbalancing this increase in supply, however, is the fact sales remain almost 30% below their ten-year seasonal average, which tells us demand is not as strong as we might expect this time of year.”

“With more supply in the form of resale inventory, and weaker demand in the form of slower sales, we’ve seen market conditions overall adjust towards more balanced conditions. It’s noteworthy that the multifamily segment remains more active than the detached segment at this time,” Lis said. “While the highest borrowing costs we’ve seen in over a decade continue to constrain affordability, a silver lining for buyers is that price increases have abated with these more balanced market conditions, meaning purchasing power is holding steady for the moment.”

LINK to the October 2023 REBGV statistics.

“With more supply in the form of resale inventory, and weaker demand in the form of slower sales, we’ve seen market conditions overall adjust towards more balanced conditions. It’s noteworthy that the multifamily segment remains more active than the detached segment at this time,” Lis said. “While the highest borrowing costs we’ve seen in over a decade continue to constrain affordability, a silver lining for buyers is that price increases have abated with these more balanced market conditions, meaning purchasing power is holding steady for the moment.”

LINK to the October 2023 REBGV statistics.

FVREB: FRASER VALLEY REAL ESTATE MARKET WEAKENS AS SALES AND PRICES CONTINUE TO EDGE DOWNWARD

Property sales and new listings in the Fraser Valley fell again in October as consumers continued to put home-buying and selling decisions on hold in the face of elevated interest rates.

“What we’re seeing in the Fraser Valley and indeed across the province is the impact of sustained high-interest rates on the overall market,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This has been the case since the latter half of the year so far, and we anticipate the trend will continue until we start to see some downward movement in the policy rate.”

“As the market continues to adjust to the new rate realities, pricing and financing strategies become critical,” said FVREB CEO, Baldev Gill.

Property sales and new listings in the Fraser Valley fell again in October as consumers continued to put home-buying and selling decisions on hold in the face of elevated interest rates.

“What we’re seeing in the Fraser Valley and indeed across the province is the impact of sustained high-interest rates on the overall market,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “This has been the case since the latter half of the year so far, and we anticipate the trend will continue until we start to see some downward movement in the policy rate.”

“As the market continues to adjust to the new rate realities, pricing and financing strategies become critical,” said FVREB CEO, Baldev Gill.

LINK to the October 2023 FVREB statistics.

VIREB: INTEREST RATES TAKING A TOLL ON HOUSING MARKET

“October was slower than expected, continuing the trend of the past few months,” says Kelly O’Dwyer, 2023 Chair. “High interest rates and a mortgage stress test of eight percent are taking a toll on demand.” In fact, the British Columbia Real Estate Association anticipates that VIREB will close out the year with around 7,100 sales, which would be the lowest number posted since 2013. “Realtors are reporting that some buyers and sellers have already decided to wait until spring to buy or list their home, hoping that interest rates will drop,” adds O’Dwyer.

VIREB: INTEREST RATES TAKING A TOLL ON HOUSING MARKET

“October was slower than expected, continuing the trend of the past few months,” says Kelly O’Dwyer, 2023 Chair. “High interest rates and a mortgage stress test of eight percent are taking a toll on demand.” In fact, the British Columbia Real Estate Association anticipates that VIREB will close out the year with around 7,100 sales, which would be the lowest number posted since 2013. “Realtors are reporting that some buyers and sellers have already decided to wait until spring to buy or list their home, hoping that interest rates will drop,” adds O’Dwyer.

LINK to the October 2023 VIREB statistics.