In the Lower Mainland, prices have remained relatively stable over the past year, without significant appreciation. The Bank of Canada's decision to maintain the interest rate at 5% has provided some relief to potential homeowners, as they can secure their mortgages at stable rates. We expect to see more buyers enter the market this month, which should bring with it a slight increase in property values for September due to the heightened competition. Anticipated increased listing activity is expected after the annual late August (Summer) slowdown, suggesting a potentially more dynamic market ahead.

REBGV: SEASONAL SLOWDOWN BRINGS PRICE STABILITY TO METRO VANCOUVER

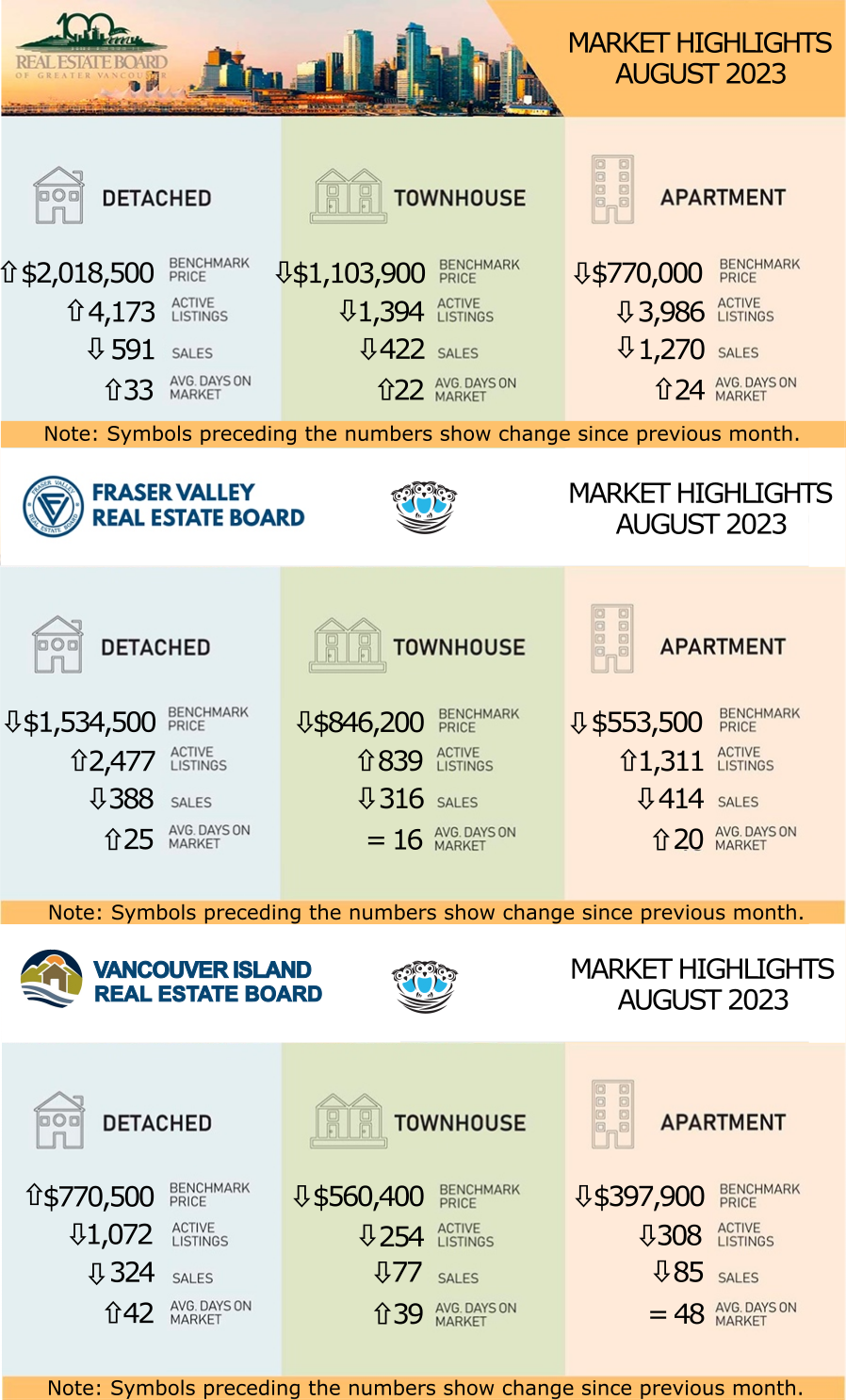

As summer winds to a close, higher borrowing costs have begun to permeate the Metro Vancouver housing market in predictable ways, with price gains cooling and sales slowing along the typical seasonal pattern.

“It’s been an interesting spring and summer market, to say the least” Andrew Lis, REBGV’s director of economics and data analytics said. “Borrowing costs are fluctuating around the highest levels we’ve seen in over ten years, yet Metro Vancouver’s housing market bucked many pundits’ predictions of a major slowdown, instead posting relatively strong sales numbers and year-to-date price gains north of 8 percent, regardless of home type.”

“It’s a bit of a tortoise and hare story this year, with sales starting the year slowly while prices increased due to low inventory levels,” Lis said. “As fall approaches, sales have caught up with the price gains, but both metrics are now slowing to a pace that is more in-line with historical seasonal patterns, and with what one might expect given that borrowing costs are where they are.”

LINK to the August 2023 REBGV statistics.

FVREB: FRASER VALLEY REAL ESTATE DIP IN AUGUST; PRICES HOLD STEADY

A combination of seasonal trends and cautious anticipation of the next rate announcement saw the Fraser Valley real estate market slow in August as sales fell slightly for the second month, after reaching a 15-month high in June.

“Many buyers are in “watchful waiting” mode as they hold off on decisions in anticipation of potential further rate changes,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “With prices relatively stable and active inventory on the rise, we hope to see more new listings come on stream over the next couple of months, especially if rates hold steady.”

A combination of seasonal trends and cautious anticipation of the next rate announcement saw the Fraser Valley real estate market slow in August as sales fell slightly for the second month, after reaching a 15-month high in June.

“Many buyers are in “watchful waiting” mode as they hold off on decisions in anticipation of potential further rate changes,” said Narinder Bains, Chair of the Fraser Valley Real Estate Board. “With prices relatively stable and active inventory on the rise, we hope to see more new listings come on stream over the next couple of months, especially if rates hold steady.”

With a sales-to-active-listings ratio of 16 percent, the market for detached homes was balanced between supply and demand. Demand for townhomes and apartments remained stronger (38 per cent and 32 per cent, respectively). The market is considered balanced when the sales-to-active-listings ratio is between 12 percent and 20 percent.

Benchmark prices in the Fraser Valley, remained relatively unchanged compared to last month with gains of less than one percent across all property types. “We expect to see market activity pick up heading into the fall months,” said FVREB CEO, Baldev Gill.

LINK to the August 2023 FVREB statistics.

VIREB: QUIET MARKET CLOSES OUT THE SUMMER

“The last two weeks of August were slower than the rest of the summer, which isn’t surprising, ” says Kelly O’Dwyer, 2023 Chair. “The market is usually pretty quiet right before school starts again.”

VIREB: QUIET MARKET CLOSES OUT THE SUMMER

“The last two weeks of August were slower than the rest of the summer, which isn’t surprising, ” says Kelly O’Dwyer, 2023 Chair. “The market is usually pretty quiet right before school starts again.”

In its Third-Quarter Housing Market Forecast, the British Columbia Real Estate Association (BCREA) reports that the B.C. housing market has been more resilient than expected in 2023, with both home sales and prices holding up well in the face of sharply higher interest rates. BCREA has projected the VIREB area to close out the year with 8,300 unit sales and is forecasting 8,800 unit sales in 2024.

While housing market activity across the province began the year well below normal, according to BCREA, the conditional pause by the Bank of Canada in January spurred a surprisingly strong recovery in the spring. Further, because inventory remains very low, prices rose through much of 2023 despite below-average sales.

LINK to the August 2023 VIREB statistics.