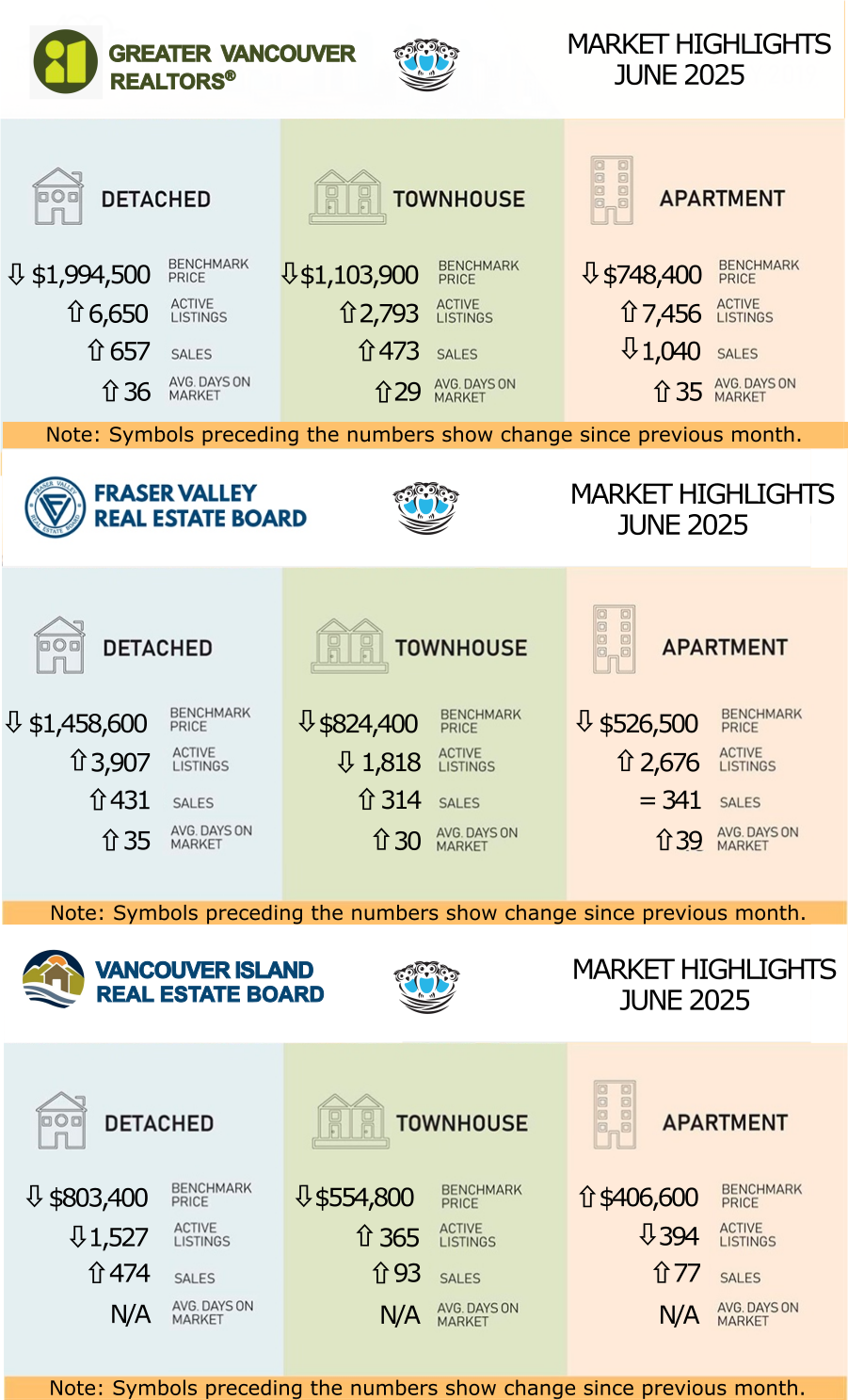

🏡 June 2025 Market Update: Balanced Conditions, More Choices for BuyersAs summer heats up, so do real estate opportunities across BC’s markets. Inventory levels are rising, prices are stabilizing, and mortgage rates remain steady, creating some of the most favourable buying conditions we’ve seen in years.🔹 Greater Vancouver saw listings jump 24% year-over-year, reaching well above the 10-year seasonal average. Sales remained steady, suggesting the market may be turning a corner after a sluggish first half. The benchmark price now sits at $1,173,100, down 2.8% annually.🔹 Fraser Valley moved deeper into buyer’s market territory, with nearly 11,000 active listings — a 30% increase from last year. The sales-to-active listings ratio held at 11%, and the benchmark price for detached homes declined to $1,458,600, a 4.6% drop from June 2024.🔹 Vancouver Island bucked the trend, with single-family home sales up 34% year-over-year and the Nanaimo benchmark price rising 2% to $837,900. The region continues to show balanced, steady demand despite broader economic headwinds.💰 Interest Rate Update

The Bank of Canada maintained its key interest rate at 2.75% on June 4th. While high by historical standards, growing speculation of a rate cut later this year is boosting market optimism and supporting buyer confidence. The chance of a rate decrease in the next Bank of Canada meeting on July 30th is only about 33%. but the odds go up for the meeting after that on September 17th. Economists are predicting a 60% chance of a 25 basis point cut on that date and up to 50 basis points by the end of 2025.🔍 What This Means for You

Buyers can enjoy greater selection and less competition in most markets — a rare opportunity to act strategically.

Sellers, on the other hand, need sharp pricing strategies and expert advice to stand out in a more crowded market.📊 Explore the full June 2025 stats:• Greater Vancouver Board

• Fraser Valley Board

• Vancouver Island Board